|

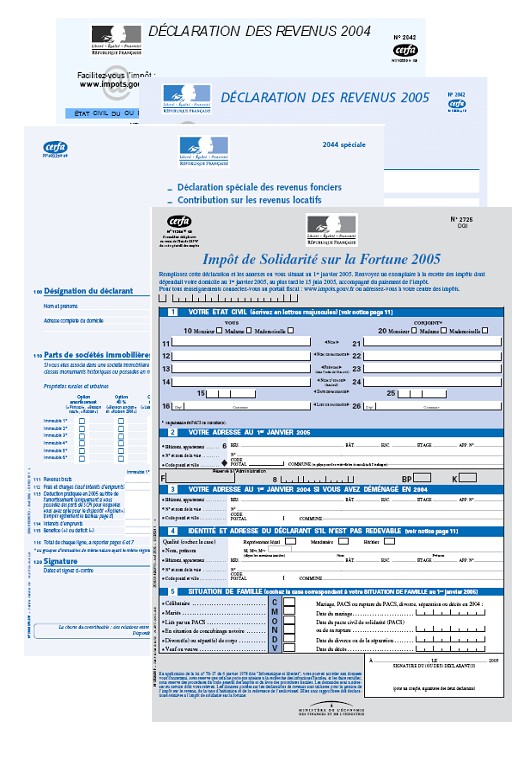

Liability to French Tax

Whether permanently resident in France or not, you should understand your French tax obligations Whether permanently resident in France or not, you should understand your French tax obligations

French taxes undergo regular changes, and it’s important to remain up to date on all taxes, including: Wealth Tax, Gift & Inheritance Taxes, Taxes on Trusts, an Exit Tax and a Tax on High Income

Despite the reputation for high taxes, French income tax is generally no higher than most other European countries. However, French social charges can be very high - and despite recent changes, special attention must still be paid to French wealth tax (IFI).

French residents are liable to French taxes on worldwide income and wealth.

An individual is considered "resident" for tax purposes in France after spending 183 days in the country. Even if you spend less than 183 days you may be still be "resident" - eg if your spouse and children are based in France, or if you spend more time in France than any other one country. You would then be liable to tax on worldwide income & capital gains, wealth, gifts and inheritance.

If you are non-resident in France, you can still be liable to French tax if you have property in France. Keeping a low profile and hoping for the best is a risk: more and more information is now accessible to the tax authorities, including electricity and phone usage.

It is important to understand the rules and pay all taxes due.

But there is no need to pay more than the minimum due.

In addition, there are various exemptions available to encourage "wealthy foreigners" to move to France.

You may also be subject to taxes in other countries due to time spent, property and assets or nationality. In this case, it is important to be aware of the dual taxation agreements. These treaties often enable significant tax savings to be obtained.

Although there are many taxes in France, such as the French wealth tax, trust tax, exit tax and various social taxes, many clients are surprised by the number of exemptions and deductions available and the importance of correctly organising their financial and personal affairs.

Copyright © 2024 Cabinet Gregory Latest modification: 29 January 2023 Email: info@cabinetgregory.com Copyright © 2024 Cabinet Gregory Latest modification: 29 January 2023 Email: info@cabinetgregory.com |

|